The Impacts of Credit Card Interest Rates on Personal Finances

The True Cost of Credit Card Interest: A Deeper Look

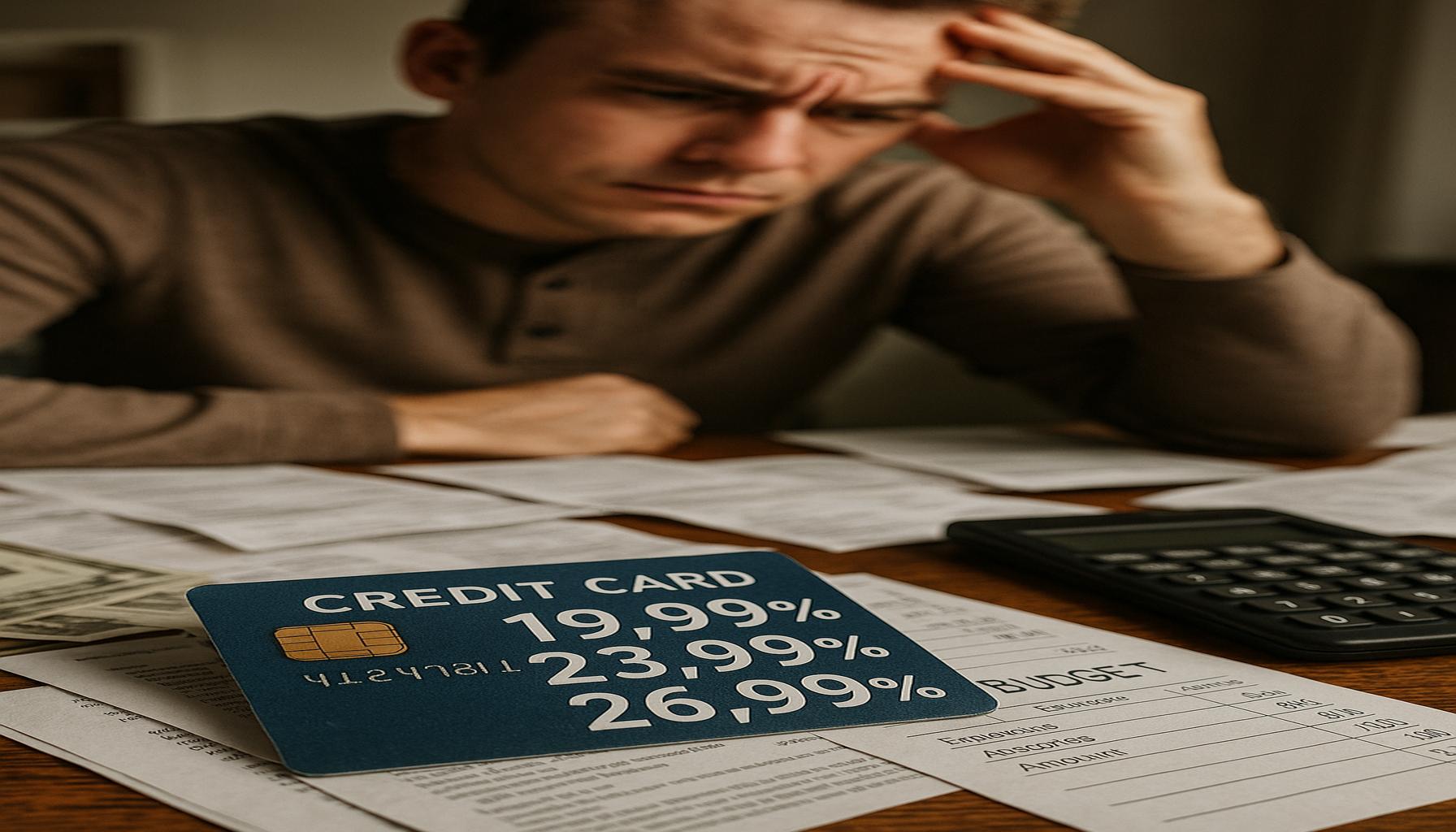

In today’s fast-paced world, managing personal finances can feel overwhelming, especially when it comes to credit cards. Many people are unaware of how interest rates can significantly impact their financial health. Understanding these rates is vital for anyone looking to achieve financial stability and peace of mind.

Let’s delve deeper into some critical aspects to consider regarding credit card interest rates:

- Rising Debt: Higher interest rates directly correlate with increased debt. For example, if you have a balance of $5,000 on a credit card with a 20% interest rate, after one year, you could owe approximately $1,000 in interest alone. This scenario illustrates how quickly debt can escalate, making it harder to pay off your balance and leading to a cycle of borrowing that is tough to escape.

- Budgeting Challenges: Increased monthly payments due to high-interest rates can stretch your budget thin. Consider a household earning $4,000 per month; if $1,000 goes to credit card payments due to high-interest rates, that’s a hefty portion of your earnings gone, leaving less for essentials like groceries, utilities, and savings. These financial constraints can lead to tough decisions and make you feel as though you’re constantly juggling bills.

- Emotional Stress: The pressure of mounting bills often leads to anxiety and a feeling of losing control over your finances. It’s common to lie awake at night worrying about upcoming payments or unexpected expenses. This emotional toll can affect your overall well-being and relationships, further complicating your financial situation.

It’s crucial to comprehend these impacts, as they intricately intertwine with daily decisions. Being informed about credit card interest rates empowers you to:

- Create a Repayment Plan: Focus on paying down high-interest debt first. Utilize strategies such as the avalanche or snowball method to effectively decrease your balances, giving you a clearer pathway to financial freedom.

- Shop for Better Rates: Don’t hesitate to seek out cards with lower interest rates or those that offer rewards aligning with your financial goals. Many credit card companies compete for your business, and a quick online search can reveal tools that help you compare rates and benefits effectively.

- Build Financial Literacy: Educate yourself on how interest is calculated, the implications of making only minimum payments, and the total cost of long-term borrowing. Resources such as community classes, online workshops, and budgeting apps can provide valuable insights and improve your understanding of personal finance.

By taking control of your credit decisions, you not only improve your grip on current financial issues but also pave the way for a secure financial future. Embrace the knowledge and tools at your disposal—you have the power to create lasting change. Stay tuned as we dive deeper into how credit card interest rates influence your life and explore strategies to make improved financial choices, ensuring your journey towards financial empowerment is fulfilling and successful.

DISCOVER MORE: Click here to learn about the latest credit card security trends in Norway</

Navigating the Complexity of Credit Card Interest

As we unpack the intricate relationship between credit card interest rates and personal finances, it’s essential to recognize the broader implications of borrowing. The choices made regarding credit can shape not only your immediate financial landscape but also establish patterns that affect your future. The initial allure of credit cards—convenience and rewards—often blinds individuals to the potential pitfalls of high interest rates.

Understanding the dynamics at play with credit card interest can uncover the hidden costs behind seemingly manageable debts. Not only do high interest rates lead to increased total balances, but they also set off a chain reaction of financial challenges that can feel insurmountable if not addressed.

- Impact on Credit Score: Elevated credit card debt due to high-interest payments can negatively affect your credit utilization ratio, a crucial component of your credit score. If your utilization exceeds 30%, it can signal to lenders that you are over-leveraged, potentially leading to higher interest rates on future loans or credit opportunities.

- Costs of Carrying a Balance: Carrying a balance month-to-month means you are paying interest on that amount, adding to your debt instead of alleviating it. For instance, if you only pay the minimum on a $3,000 balance at a 22% interest rate, it could take over five years to pay it off with a total of nearly $1,500 in interest. The financial burden can feel like a heavy weight, hindering your ability to save or invest in important life goals.

- Opportunity Lost: Money spent on hefty interest payments is money that could have been directed towards building an emergency fund, investing in a retirement account, or even pursuing experiences that enrich your life. High interest rates not only consume your financial resources but also limit your ability to create wealth and stability.

Taking a proactive stance in understanding these implications allows individuals to make informed choices about their credit cards and borrowing habits. Here are some strategies that can support healthier financial decisions:

- Track Your Spending: Regularly monitor your credit card transactions to ensure you remain within your budget and can manage payments effectively.

- Consider Consolidation Options: If you already carry high-interest debt, look into options such as debt consolidation loans that can provide lower interest rates and more manageable payment structures.

- Establish a Solid Financial Plan: A robust financial plan that accounts for debt repayment, savings, and investments can help navigate the complexities of credit card usage and preserve financial health in the long run.

By acknowledging the weight of credit card interest rates on personal finances, individuals can better prepare themselves for a more secure financial future. Making deliberate choices now will lead to less financial strain and pave the way for opportunities that promote stability and growth. Embrace the journey to financial literacy, and empower yourself to take control of your financial destiny.

DIVE DEEPER: Click here to learn more

The Ripple Effects of High Interest Rates

While the immediate impacts of credit card interest rates are glaringly evident in monthly statements, the long-term consequences can often be overlooked. High interest rates not only trap individuals in cycles of debt but also hinder their financial growth and overall well-being. As we delve deeper into these ramifications, it’s essential to recognize that every choice carries weight, particularly in an environment where financial literacy is more crucial than ever.

One of the most significant repercussions of elevated interest rates is their effect on savings habits. When a considerable portion of your income is allocated to interest payments, it leaves little room for saving or investing. According to recent studies, the average American household, burdened by credit card debt, struggles to maintain an emergency fund. This lack of savings can lead to devastating consequences, particularly in times of unforeseen expenses such as medical emergencies or car repairs. Without a safety net, individuals may have no choice but to rely on credit, thereby perpetuating a cycle of debt.

An additional layer to consider is the emotional toll that high-interest credit cards can inflict. The stress associated with mounting debt can lead to mental health challenges, including anxiety and depression, which in turn can affect productivity and relationships. A National Endowment for Financial Education survey revealed that financial stress is a significant source of anxiety for many Americans, often overshadowing other aspects of life. When your focus is diverted by financial worries, it’s challenging to cultivate a mindset geared toward growth and opportunity.

Moreover, it’s vital to acknowledge how credit card interest rates can contribute to the widening wealth gap in society. As those with lower incomes often face the highest interest rates, the burden becomes more pronounced, limiting their ability to invest in education or housing. In the U.S., people from lower socioeconomic backgrounds frequently face obstacles in obtaining lower interest rates due to poor credit histories, making it difficult to break free from the cycle of debt. This perpetuates a cycle of poverty that can affect generations.

Learning Tools for Financial Empowerment

To combat the adverse effects of credit card interest rates, it’s essential to equip oneself with knowledge and practical tools. Here are some steps towards empowerment:

- Educate Yourself on Interest Calculations: Understanding how interest is calculated on credit card balances can help you make informed decisions about usage and repayment strategies. Familiarize yourself with concepts such as APR (Annual Percentage Rate) and how it affects your payments.

- Utilize Budgeting Tools: Leverage technology to your advantage. Numerous apps and software can help you track expenses, set saving goals, and manage credit. A budget that limits discretionary spending can re-route funds towards more productive uses.

- Engage in Financial Literacy Workshops: Many community programs and non-profit organizations offer free resources to strengthen financial understanding. Participating in these workshops can equip you with actionable strategies for smarter spending and debt management.

By recognizing the broader consequences of high credit card interest rates, individuals can take proactive measures to safeguard their finances and enhance their quality of life. It is imperative to be proactive, informed, and intentional with your financial decisions, paving the way for a more secure and fulfilling future.

DON’T MISS: Click here to discover how to choose the right credit card

Building a Brighter Financial Future

In conclusion, the influence of credit card interest rates on personal finances extends far beyond monthly expenditures, shaping both the immediate and long-term financial landscape of individuals. High interest rates can easily entrap consumers in a cycle of debt that impedes their ability to save, invest, and even achieve life goals like homeownership or retirement. The emotional and psychological burdens that accompany financial stress are profound, affecting overall well-being and quality of life.

This underlines the importance of fostering financial literacy and cultivating informed decision-making skills. Understanding the mechanics of interest accumulation, creating effective budgets, and participating in educational workshops can empower individuals to take control of their financial circumstances. It is crucial to shift perspectives—view credit not as a mere purchasing tool but as a potential pitfall that requires cautious management.

Furthermore, acknowledging the broader societal implications of credit card interest rates can foster greater empathy and understanding of the challenges faced by those in lower socioeconomic brackets. By advocating for reforms in lending practices and supporting financial education initiatives, we can work towards bridging the wealth gap and creating a more equitable financial landscape for all.

Ultimately, the journey to financial wellness begins with a single step—knowledge and awareness. By making conscious and responsible financial choices today, individuals can pave the way for a secure and prosperous tomorrow, breaking free from the chains of debt and building a legacy of empowerment for future generations.

Related posts:

How to Apply for HSBC World Elite Mastercard Credit Card Easily

How to Apply for Choice Privileges Select Mastercard Credit Card

Apply for Banana Republic Rewards Mastercard Credit Card Easily

How to Avoid Debt: Strategies for Using Credit Cards Responsibly

Apply for the Bank of America Premium Rewards Elite Credit Card - Step-by-Step Guide

Apply for a Goodyear Credit Card Step-by-Step Guide Benefits

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.